November 20th, 2024 | Sterling

International Fraud Awareness Week

International Fraud Awareness Week is a global initiative driven by leaders, professionals, and organisations with the goal of reducing the widespread impact of fraud. It promotes anti-fraud awareness and education as a collective effort across industries and communities. This week is a dedicated time for raising awareness about the serious risks of fraud, encouraging individuals, families, and businesses to remain vigilant and proactive in protecting their personal and professional information.

Advances in technology mean the risk of fraud has grown exponentially. With the proliferation of online transactions, data sharing, and digital platforms, individuals and organisations are more exposed than ever to increasingly sophisticated fraudulent schemes.

How Does Fraud Affect Us?

Fraud can have a profound financial impact on businesses, regardless of size. However, the scale and severity of the losses often vary depending on the organisation’s resources and capacity to absorb such incidents.

Research has shown that larger organisations, with over 10,000 employees, experience the highest median losses, around USD 200,000. Meanwhile, smaller businesses, with fewer than 100 employees, face a median loss of USD 141,000. Since smaller businesses have less money to work with, they feel the financial hit much harder.

Beyond the size of the business, certain types of fraud can affect organisations across the board, many of which directly impact hiring programs, including:

#1 Identity Theft

Identity theft is one of the most significant and most complex types of fraud. In the most frightening scenario, someone steals your personal information and uses that information to carry out fraudulent activity such as opening new lines of credit. Identity theft is a growing concern globally, with advanced technologies like deepfakes becoming increasingly used to commit fraud.

In the Asia-Pacific region, 2023 saw a 1,530% increase in deepfake-related incidents, the second highest in the world after North America. The Philippines experienced the largest surge, with a staggering 4,500% increase in deepfake cases, followed by Hong Kong with a 1,300% rise. Similarly, Malaysia and Singapore witnessed significant jumps of 1,000% and 500%, respectively.

Additionally, according to a Consumer Survey by FICO, Indians are four times more likely to report being victims of identity theft compared to Indonesians. In India, 13% of people said their identity had been used to open a financial account, while in Indonesia, this figure was only 3%, suggesting that fraudsters in India have sufficient information to open accounts using stolen identities.

As these numbers show, the use of advanced technology to commit fraud is becoming a growing concern, underscoring the need for heightened awareness and stronger preventative measures.

Whether accidentally or intentionally, candidates sometimes provide inaccurate identity information. Implementing a robust background screening and identity verification program with Sterling can help protect your business from identity theft and fraud, especially when we can provide an extensive suite of global identity and screening services in 240+ countries and territories.

#2 Resume Fraud

Resume fraud, in which job applicants intentionally falsify information on their resumes, is often overlooked by some hiring leaders and professionals during the hiring process. According to the report from StandOut-CV, over 64.2% of respondents admitted to lying on their resume at least once. Additionally, younger candidates are more likely to lie on a resume than older individuals, with a staggering 80.4% of 18- to 25-year-olds admitting they have lied before.

While there are many reasons why people commit resume fraud, it’s often done to improve their chances of being hired. In a competitive job market, younger candidates may be more willing to do anything to secure employment, especially if they lack the relevant work experience needed to get the job they want. As the report suggests, this is a strategy that many candidates have successfully adopted to secure work.

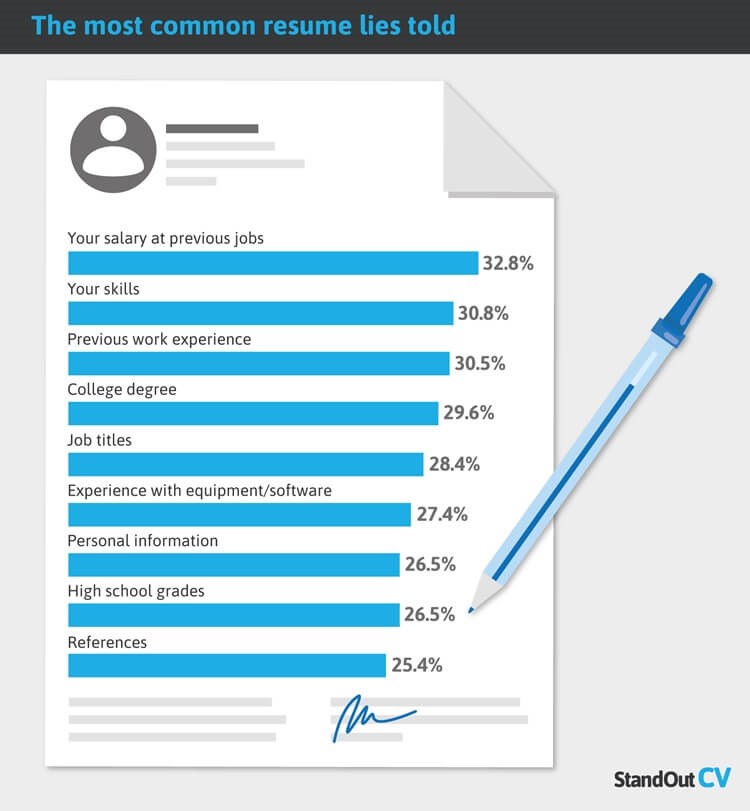

But which part of the resume do they embellish? (See figure 1)

Source: retrieved from published information by Standout-cv.com

#3 Occupational Fraud

Fraud poses a wide range of risks, and some of the most serious threats come from within organisations themselves. Occupational fraud occurs when individuals exploit their position of trust, often to the detriment of the company. This threat is typically associated with current employees, but contractors, temporary workers, and gig workers with access to company resources can all put the organisation at risk.

According to Occupational Fraud 2024: A Report to the Nations from the Association of Certified Fraud Examiners (ACFE), 1,921 cases of occupational fraud were reported across 138 countries, with reported losses of more than $3.1 billion incurred by affected companies. In Asia-Pacific alone, the region saw the highest average loss at $1.2 million, compared to Western Europe, which came in second with losses of $1 million.

How Sterling Help Mitigates Fraud Risks

Given the serious impact of fraud on businesses, institutions, organisations and individuals, raising fraud awareness is important to all of us. Promoting a culture of accountability and integrity can significantly reduce the risk of becoming one of the victims, which is why governments and law enforcement authorities encourage stakeholders to take active steps in preventing fraud.

One effective way to mitigate risk is by implementing a comprehensive background check program. These programs may include identity verification, reported crime activity, pre-employment screening, credit checks, and right-to-work verification. For example, by ensuring you’re engaging with genuine individuals, employees, and candidates, your organisation can safeguard itself from potential fraud.

Whilst there may be an initial investment of time and money, the long-term protection, safety, and peace of mind it can provide makes it invaluable for the future of your organisation and your most important resource, people.

How Can Sterling Help?

Sterling is a recognised expert at delivering background screening services to businesses throughout the Asia-Pacific region. We have nuanced experience and knowledge of each of the markets in which we operate and can therefore offer customised services suited to your unique hiring needs.

Learn more about how you can incorporate trust and safety into your hiring program: contact us here to discuss your needs.

This content is offered for informational purposes only. First Advantage is not a law firm, and this content does not, and is not intended to, constitute legal advice. Information in this may not constitute the most up-to-date legal or other information.

Readers of this content should contact their attorney or lawyer to obtain advice concerning any particular legal matter. No reader, or user of this content, should act or refrain from acting on the basis of information in this content without first seeking legal advice from counsel or lawyers in the relevant jurisdiction. Only your individual attorney or legal advisor can provide assurances that the information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation. Use of, and access to, this content does not create an attorney-client relationship between the reader, or user of this presentation and First Advantage.